Is the Inclusive Post-R & D Subsidy Policy Effective:An Empirical Study of Enterprises in Guangdong

-

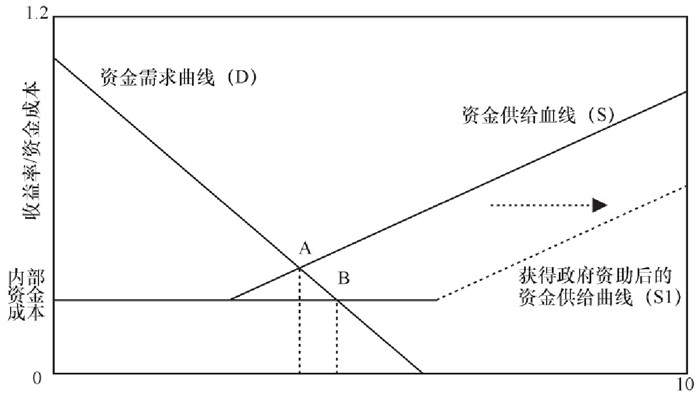

摘要: 近年来, 我国各地开始探索企业R & D投入的财政后补助机制, 即如何根据企业R & D投入强度进行普惠性事后补助。不同于事前立项资助方式和研发费用加计扣除税收减免的资助方式, 财政后补助方式改变了企业R & D预算约束和R & D投入产出预期, 对企业的R & D投入具有重要影响。选取2015—2017年广东普惠性研发后补助资助的企业面板数据, 实证检验普惠性企业R & D后补助政策对企业R & D投入的影响。结果表明:研发后补助政策对企业研发投入具有净引致效应, 引致系数为1. 235;企业规模、成长阶段、行业领域等企业异质性均对政策实施效果有显著影响; 研发后补助政策对企业R & D投入影响的时滞性低于立项资助方式影响的时滞性。Abstract: More and more Innovation Bureaus in China have begun to use the post-R & D subsidy to stimulate enterprise innovation. It's a different policy from traditional R & D subsidy and tax-reduction, which can change the constraint of firm's R & D budget and the expectation of R & D input and output. Based on the panel data of firms which received the post-R & D subsidy in Guangdong from 2015-2017, this paper empirically examines the impact of post-R & D subsidy on firm's R & D investment. The results show that the post-R & D subsidy has a crowding effect on the firm's R & D investment, with a coefficient of 1. 208, that enterprise heterogeneity has a significant impact on policy effect, such as firm's size, growth stage and industry field, and that the post-R & D subsidy has significant time lag.

-

表 1 样本企业的描述性统计

企业异质性维度 企业特征 观测值个数 企业规模 小型 330 中型 155 大型 84 企业成长阶段 初创期 118 成长期 317 稳定期 106 企业行业技术领域 高技术行业 315 低技术行业 49 表 2 普惠性R & D后补助政策影响企业研发投入的回归结果

企业异质性 企业特征 解释变量 LnSubsidyit LnRd_Pit LnProfitit C Observations 样本 — 1.235***

(0.000)-0.154***

(0.000)0.021**

(0.025)2.184***

(0.000)799 企业规模 小型 1.184***

(0.000)-0.050*

(0.099)0.007

(0.558)1.899***

(0.000)330 中型 1.188***

(0.000)-0.157***

(0.000)0.028**

(0.055)2.432***

(0.000)155 大型 1.164***

(0.000)-0.208***

(0.000)0.080***

(0.006)2.632***

(0.000)84 企业成长阶段 初创期 1.111***

(0.000)-0.015

(0.607)0.034***

(0.007)1.943***

(0.000)118 成长期 1.256***

(0.000)-0.125***

(0.001)0.017

(0.272)1.975***

(0.000)317 稳定期 1.117***

(0.000)-0.135***

(0.000)0.037**

(0.039)2.509***

(0.000)106 企业行业

技术领域高技术行业 1.251***

(0.000)-0.124***

(0.000)0.029*

(0.088)1.887***

(0.000)49 低技术行业 1.150***

(0.000)-0.144***

(0.000)-0.013

(0.433)2.559***

(0.000)315 注:***、**、*分别表示在1%、5%、10%水平下显著,表 3同。 表 3 普惠性R & D后补助政策影响企业研发投入的滞后分析结果

解释变量 模型设定型设定 模型1-2-1 模型1-2-2 模型1-2-3 LnSubsidyt 1.235*** (0.000) 1.417*** (0.000) 1.704*** (0.000) LnSubsidyt-1 — 0.110*** (0.001) -0.194*** (0.000) LnSubsidyt-2 — — -0.021 (0.413) LnRd_P -0.154*** (0.000) -0.222*** (0.000) 0.012 (0.554) LnProfit 0.021** (0.025) 0.003** (0.022) 0.004 (0.746) C 2.184*** (0.000) 1.196** (0.048) 0.606*** (0.000) -

[1] SCHUMPETER J A. Capitalism, socialism and democracy[M]. New York: Harper & Brothers, 1942. [2] ARROW K. Economic welfare and the allocation of resources for invention[M]∥NELSONP R. The rate and direction of inventive activity: economic and social factors. Princeton: Princeton University Press, 1962: 609-626. [3] DAVID P A, HALL B H, TOOLE A A. Is public R & D a complement or substitute for private R & D?a review of the econometric evidence[J]. Research policy, 2000, 29(4-5): 497-529. doi: 10.1016/S0048-7333(99)00087-6 [4] LINK A N. Productivity growth, environmental regulations and the composition of R & D[J]. The bell journal of economics, 1982, 13(2): 548-554. doi: 10.2307/3003474 [5] LEVY D M, TERLECKYJ N E. Effects of government R & D on private R & amp; D investment and productivity: a macroeconomic analysis[J]. Bell journal of economics, 1982, 14(2): 551-561. [6] 朱平芳, 徐伟民.政府的科技激励政策对大中型工业企业R & D投入及其专利产出的影响---上海市的实证研究[J].经济研究, 2003(6): 45-53, 94. [7] CARMICHAEL J. The effects of mission-oriented public R & D spending on private industry[J]. The journal of finance, 1981, 36(3): 617-627. doi: 10.1111/j.1540-6261.1981.tb00648.x [8] HIGGINS R S.Federal support of technological growth in industry:some evidence of crowding out[J]. IEEE transactions on engineering management, 1981, EM-28(4):86-88. doi: 10.1109/TEM.1981.6447450 [9] 姚洋, 章奇.中国工业企业技术效率分析[J].经济研究, 2001(10): 13-19. doi: 10.3969/j.issn.1000-3894.2001.10.003 [10] 安同良.中国企业的技术选择[J].经济研究, 2003(7): 76-84. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ200307009.htm [11] 董雪兵, 王争. R & D风险、创新环境与软件最优专利期限研究[J].经济研究, 2007(9): 112-120. doi: 10.3969/j.issn.1005-913X.2007.09.048 [12] 周海涛.政府R & D资助对企业技术创新决策、行为及绩效的影响研究[D].广州: 华南理工大学, 2016. [13] A SHAH. Fiscal incentives for investment and innovation[M]. New York: Oxford University Press, 1995: 341-374. [14] MAMUNEAS T P, NADIRII M. Public R & D policies and cost behavior of US manufacturing industries[J]. Journal of public economics, 1996, 63(1): 57-81. doi: 10.1016/S0047-2727(96)01588-5 [15] 胡明勇, 周寄中.政府资助对技术创新的作用:理论分析与政策工具选择[J].科研管理, 2001(1): 31-36. https://www.cnki.com.cn/Article/CJFDTOTAL-KYGL200101004.htm [16] 熊维勤.税收和补贴政策对R & D效率和规模的影响---理论与实证研究[J].科学学研究, 2011(5): 698-706. [17] BARNEYJ B. Resource-based theories of competitive advantage: a ten-year retrospective on theresource-based view[J]. Journal of management, 2001, 27(6): 643-650. doi: 10.1177/014920630102700602 [18] COHENW M, KLEPPER S. A reprise of size and R & D[J]. Economic journal, 1996, 437: 925-951. [19] LOOF H, HESMATI A. The impact of public funding on private R & D investment: new evidence from a firm level innovation study[R]. CESIS, Electronic working paper series, 2004: 6. [20] KUMAR N, SAQIB M. Firm size, opportunities for adaptation and in-house R & D activity in developing countries: the case of Indian manufacturing[J]. Research policy, 1996, 25(5): 713-722. doi: 10.1016/0048-7333(95)00854-3 [21] BETTINA BECKER, STEPHEN G HALL. The determinants of high-tech versus low-tech R & D investment: evidence from testing the pooling assumption[C]. NIESER discussion papers, 2003: 217. [22] LEE M H, HWANG I J. Determinants of corporate R & D investment: an empirical study comparing korea's IT industry with its non-IT industry[J]. ETRI journal, 2003, 25(4): 258-265. doi: 10.4218/etrij.03.0101.0401 [23] HALL B H. The financing of research and development[J]. Oxford review of economic policy, 2002, 18(1): 35-51. doi: 10.1093/oxrep/18.1.35 [24] HALL B H, REENEN J V. How effective are fiscal incentives for R & D?a new review of the evidence[J]. NBER working papers, 1999, 29(4): 449-469. [25] GRILICHES Z. The search for R & D spillovers[J]. Nberchapters, 1991, 94(18): 29-47. [26] FAZZARI S M, HUBBARD R G, PETERSEN B C. Financing constraints and corporate investment[J]. Brookings papers on economic activity, 1988, 19(1): 141-195. http://en.cnki.com.cn/Article_en/CJFDTOTAL-JZGC200506039.htm [27] KAPLAN S, ZINGALES L. Do financial constraints explain why investment is correlated with cash flow?[J]. Quarterly journal of economics, 1997, 112(1): 169-215. doi: 10.1162/003355397555163 [28] LERNER J. The government as venture capitalist[J]. Journal of private equity, 1996, 3(2): 55-78. http://gateway.proquest.com/openurl?res_dat=xri:pqm&ctx_ver=Z39.88-2004&rfr_id=info:xri/sid:baidu&rft_val_fmt=info:ofi/fmt:kev:mtx:article&genre=article&jtitle=Journal%20of%20Private%20Equity&atitle=The%20Government%20as%20Venture%20Capitalist [29] ANTONELLI C. A failure-inducement model of research and development expenditure.[J]. Journal of economic behavior and organization, 1989, 12(2): 159-180. doi: 10.1016/0167-2681(89)90053-X [30] HIMMELBERG C P, PETERSEN B C. R & D and internal finance: a panel study of small firms in high-tech industries[J]. Review of economics statistics, 1994, 76: 33-60. [31] 周海涛, 张振刚.政府研发资助方式对企业创新投入与创新绩效的影响研究[J].管理学报, 2015(12): 1797-1804. doi: 10.3969/j.issn.1672-884x.2015.12.009 [32] BECKER B, HALL S G. The determinant of high-versus low-tech R & D investment: evisence from testing the pooling assumption[C]. NIESER discussion papers, 2003: 217. [33] 戴小勇, 成力为.财政补贴政策对企业研发投入的门槛效应[J].科研管理, 2014(6): 68-76. https://www.cnki.com.cn/Article/CJFDTOTAL-KYGL201406009.htm [34] 程华, 赵祥.政府科技投入与企业R & D: 实证研究与政策选择[M].上海: 科学出版社, 2009. [35] HAMBERGD. Essays on the economics of research and development[M]. New York: Random House, 1966: 170. [36] 赵炼钢.企业生命周期及战略应用[J].企业研究, 2002(6): 23-25. https://www.cnki.com.cn/Article/CJFDTOTAL-QYYJ200207008.htm [37] 孙怀平, 杨东涛, 王洁心.基于生命周期的领导风格对人力资源管理实践影响研究[J].科学学与科学技术管理, 2007(3): 166-169. doi: 10.3969/j.issn.1002-0241.2007.03.035 -

下载:

下载: