On the Impact of Local Government Special Bonds on Private Investment

-

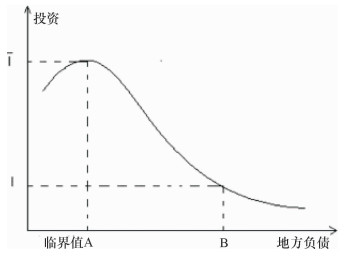

摘要: 基于地方政府债务增长与民间投资的数理模型, 利用省级层面的宏观数据分析地方政府专项债券发行对民间投资的影响。研究发现地方政府债务总体而言会抑制民间投资, 但考虑专项债政策的影响后, 专项债对民间投资并没有显著的线性关系; 且专项债规模低于一定水平时会拉动民间投资水平, 超过最优规模则会对民间投资产生抑制作用, 一般债券与民间投资存在类似的非线性关系, 两者的拐点分别是22.68%和29.95%。此外, 专项债券、一般债券对不同类别的民间投资水平存在异质性影响。当前应根据地方的经济实力, 合理安排地方政府专项债券和一般债券的规模, 缩小地方政府债务限额和余额的差额, 并通过改善宏观经济政策环境促进民间投资水平的提升。Abstract: Based on the mathematical model of local government debt growth and private investment, this paper analyzed the impact of the issuance of local government special bond on private investment by using macro data at the provincial level. The results show that the local government debt in general would inhibit private investment, but after considering the impact of special debt policy, the special debt has no significant linear relationship with private investment; when the scale of special debt is lower than a certain level, it will stimulate private investment; when exceeding the optimal scale, it inhibits private investment. There is a similar nonlinear relationship between general bond and private investment, at an inflection point 22. 68%and 29. 95% respectively. In addition, special bonds and general bonds have heterogeneous effects on different types of private investment. At present, according to the local economic strength, the government should reasonably arrange the scale of local government special bonds and general bonds, reasonably reduce the difference in debt limit and balance between local government, and improve the macroeconomic policy environment to promote the level of private investment.

-

Key words:

- government debt /

- local government debt /

- special bond /

- general bond /

- social investment /

- private investment

-

表 1 变量的描述性统计结果

变量名称 平均值 标准差 最小值 中位数 最大值 民间投资比重 67.83 11.27 21.88 69.26 87.34 政府债务/GDP 0.286 0.154 0.0500 0.253 0.947 专项债/GDP 0.096 0 0.053 0 0.003 00 0.090 0 0.357 一般债/GDP 0.181 0.108 0.048 0 0.151 0.560 ln(经济开放度) 2.752 2.033 -2.160 2.708 7.491 ln(政府规模) 2.374 0.260 1.789 2.360 3.124 ln(人均GDP) 10.73 0.450 9.482 10.68 11.85 城市人口密度 2 825 1 168 764 2 626 5 821 城镇化 56.14 12.89 27.74 54.34 89.60 企业税收负担 1.247 0.859 0.334 1.005 4.744 表 2 专项债券政策实施对民间投资的影响

变量 (1) (2) (3) L.民间投资 0.656 9*** 0.652 1*** 0.650 3*** (0.093 2) (0.096 1) (0.096 2) 政府债务占比 -10.417 7*** -10.125 7*** -10.058 6*** (3.607 1) (3.707 0) (3.743 5) D 0.000 8 (0.001 3) D×政府债务占比 0.001 8 (0.002 5) ln(经济开放度) 3.134 6* 3.091 1* 3.077 0* (1.764 8) (1.775 7) (1.780 3) ln(政府规模) -0.653 6** -0.696 8** -0.735 9** (2.922 1) (3.076 3) (3.120 5) ln(人均GDP) 5.083 2** 5.217 8*** 5.319 2*** (4.474 8) (4.494 7) (4.506 6) 人口密度 0.000 9*** 0.000 9*** 0.000 9*** (0.000 8) (0.000 8) (0.000 8) 城镇化率 -0.116 7 -0.129 1 -0.131 4 (0.128 7) (0.133 7) (0.132 7) 税收负担 -1.591 3 -1.498 6 -1.473 6 (1.536 2) (1.542 8) (1.551 0) AR(1) 0.001 0 0.015 5 0.077 4 AR(2) 0.721 0 0.247 5 0.625 9 Sargan检验 0.123 3 0.146 7 0.074 9 注:***、**、*分别代表 1%、5%、10%的显著性水平,各回归系数括号内为稳健性回归标准误。下表同。 表 3 专项债券和一般债券规模对民间投资的影响

变量 (1) (2) (3) (4) L.民间投资 0.402 3*** 0.269 1 0.352 2** 0.352 2** (0.079 9) (0.171 6) (0.139 6) (0.139 6) special 14.381 9 229.450 9* (36.743 3) (118.277 8) special_sq -505.826 8* (273.632 3) ordinary -25.835 5 43.979 4** (38.712 0) (88.242 4) ordinary_sq -73.418 5* (101.214 7) ln(经济开放度) 1.638 3 1.285 4 2.665 3 2.738 1 (4.352 1) (4.363 0) (4.186 7) (4.116 7) ln(政府规模) -1.277 2 -5.267 4 -1.200 2 -1.486 9 (6.323 7) (7.023 7) (5.399 2) (5.547 5) ln(人均GDP) -1.258 5 11.127 5 -6.895 3 -8.329 1 (7.708 3) (10.103 3) (10.683 8) (12.725 9) 人口密度 0.000 0 0.001 0 -0.000 1 -0.000 2 (0.001 1) (0.001 3) (0.001 1) (0.001 2) 城镇化率 -0.137 9 -1.010 0 -0.262 6 -0.307 0 (0.470 1) (0.671 8) (0.470 4) (0.439 7) 税收负担 -1.291 2 0.276 9 -1.166 0 -1.255 7 (1.469 6) (2.268 8) (1.548 1) (1.640 4) AR(1) 0.029 0 0.135 0 0.070 2 0.088 3 AR(2) 0.191 1 0.278 9 0.212 3 0.635 9 Sargan检验 0.233 2 0.152 1 0.118 7 0.083 2 表 4 专项债对不同类别的民间投资的影响

民间投资类别 (1) (2) (3) (4) (5) (6) (7) (8) 个体 股份 集体 联营 内资 私营 有限 其他 L.个体 0.413 1*** (0.053 7) L.股份 -0.002 8 (0.121 7) L.集体 0.382 3*** (0.051 6) L.联营 0.192 8*** (0.051 8) L.内资 -2.797 5* (1.519 5) L.私营 0.270 5 (0.173 5) L.有限 -0.068 8 (0.154 3) L.其他 0.085 7 (0.145 9) special -13.002 1 -2.112 4 28.108 0*** 5.388 7** 216.674 8 -43.012 4 399.893 9*** -18.471 5 (15.309 5) (4.098 1) (10.106 9) (2.360 1) (314.095 6) (97.376 5) (116.032 2) (23.831 1) special_sq 29.968 0 -3.284 5 -66.783 1*** -12.564 6** -218.009 6 135.558 5 -879.038 6*** 13.921 4 (26.822 8) (6.650 6) (23.176 9) (4.985 4) (527.120 6) (236.933 6) (204.143 0) (51.670 6) 控制变量 Yes Yes Yes Yes Yes Yes Yes Yes AR(1) 0.073 0 0.131 0 0.080 2 0.153 3 0.100 9 0.153 1 0.089 0 0.067 2 AR(2) 0.307 1 0.827 3 0.258 3 0.460 2 0.237 1 0.460 4 0.885 2 0.234 8 Sargan检验 0.121 1 0.227 6 0.296 1 0.140 9 0.209 3 0.140 8 0.129 3 0.359 2 表 5 一般债券对不同类别民间投资的影响

民间投资类别 (1) (2) (3) (4) (5) (6) (7) (8) 个体 股份 集体 联营 内资 私营 有限 其他 L.个体 0.409 0*** (0.053 2) L.股份 0.083 6 (0.105 3) L.集体 0.416 5*** L.联营 (0.049 1) L.内资 0.189 3*** (0.047 9) L.私营 -2.118 1 L.有限 (1.314 3) L.其他 0.222 9 (0.184 7) L.个体 0.183 4 L.股份 (0.146 0) 0.094 2 L.集体 (0.146 7) ordinary 39.979 3*** 4.562 2 -1.102 6 -2.466 9 756.554 4*** 256.440 2*** 204.815 9** 6.629 1* (12.492 4) (3.905 5) (13.706 8) (2.347 1) (233.994 9) (82.615 9) (99.163 8) (29.786 7) ordinary_sq -43.384 1*** -4.938 6 -2.801 0 2.338 3 -656.165 9*** -225.730 4*** -232.089 5** -8.256 4* (16.186 7) (4.777 4) (14.912 6) (2.614 0) (226.130 9) (86.954 7) (106.268 4) (32.892 0) 控制变量 Yes Yes Yes Yes Yes Yes Yes Yes AR(1) 0.078 1 0.080 2 0.025 2 0.084 4 0.022 1 0.113 9 0.033 2 0.067 1 AR(2) 0.425 5 0.511 8 0.180 2 0.303 0 0.625 5 0.898 3 0.198 7 0.226 3 Sargan检验 0.371 3 0.169 2 0.427 7 0.242 1 0.136 7 0.193 0 0.178 3 0.217 1 表 6 考虑内生性问题的回归结果

变量 政府债务 专项债 一般债 (1) (2) (3) (4) (5) (6) (7) L.民间投资 0.663 1*** 0.674 0*** 0.675 9*** 0.003 9 0.060 2 0.030 8 0.036 3 (0.085 2) (0.084 7) (0.085 2) (0.068 6) (0.068 6) (0.077 3) (0.071 2) L.政府债务占比 -2.172 4* -2.569 4* -2.476 9* (3.828 6) (3.820 7) (3.813 3) L.D -0.001 8 (0.001 2) L.D×政府债务占比 -0.003 4 (0.002 4) L.special 39.350 6*** 32.273 4 (12.009 8) (34.365 2) L.special_sq -162.304 6** (75.844 2) L.ordinary 14.544 6 31.134 8* (11.576 2) (61.251 3) L.ordinary_sq -61.114 3* (70.200 8) 控制变量 Yes Yes Yes Yes Yes Yes Yes AR(1) 0.002 2 0.002 6 0.002 3 0.156 1 0.221 4 0.156 7 0.221 3 AR(2) 0.362 1 0.349 3 0.364 2 0.348 5 0.445 6 0.317 5 0.584 3 Sargan检验 0.532 3 0.426 9 0.416 0 0.274 9 0.226 6 0.378 3 0.474 2 表 7 稳健性检验Ⅰ: 剔除极端值

变量 (1) (2) L.民间投资 0.057 6 0.029 4 (0.068 6) (0.080 6) L.special -11.636 7* (6.134 2) L.special_sq 7.820 9*** (2.498 2) L.ordinary 2.442 8* (4.970 7) L.ordinary_sq -10.233 3* (0.497 8) 控制变量 Yes Yes AR(1) 0.048 0 0.242 5 AR(2) 0.321 1 0.448 6 Sargan检验 0.178 2 0.164 9 表 8 稳健性检验Ⅱ: 改变被解释变量测度方式

变量 (1) (2) L.民间投资 0.164 1*** 0.165 8*** (0.050 2) (0.048 3) L.special 11.662 7* (9.144 3) L.special_sq -6.050 2** (4.744 2) L.ordinary -0.307 7 (4.546 1) L.ordinary_sq -0.064 6* (0.459 2) 控制变量 Yes Yes AR(1) 0.044 2 0.241 3 AR(2) 0.307 8 0.335 2 Sargan检验 0.274 3 0.189 7 -

[1] REINHART C M, REINHART V R, ROGOFF K S. Public debt overhangs: advanced-economy episodes since 1800[J]. Journal of Economic Perspectives, 2012, 26(3): 69-86. doi: 10.1257/jep.26.3.69 [2] CHECHERITA-WESTPHAL C, ROTHER P. The impact of high government debt on economic growth and its channels: an empirical investigation for the Euro area[J]. European Economic Review, 2012, 56(7): 1392-1405. doi: 10.1016/j.euroecorev.2012.06.007 [3] MENCINGER J, ARISTOVNIK A, VERBIC M. The impact of growing public debt on economic growth in the European Union[J]. Amfiteatru Economic Journal, 2014, 16(35): 403-414. http://www.ingentaconnect.com/content/doaj/15829146/2014/00000016/00000035/art00025 [4] 刘孝斌, 钟坚. 中国会爆发公共债务危机吗——基于财政可持续性条件视角[J]. 广东财经大学学报, 2018(6): 43-57. https://www.cnki.com.cn/Article/CJFDTOTAL-SONG201806006.htm [5] 闫衍, 袁海霞, 汪苑晖. 补短板专项债加速发行, 稳增长基建托底经济——地方政府债券撬动投资规模的测算及展望[J]. 财政科学, 2019(6): 33-47, 53. https://www.cnki.com.cn/Article/CJFDTOTAL-CZKX201906004.htm [6] 闻之. 中央再放地方政府专项债券"大招"[J]. 时代金融, 2019(22): 14-15. https://www.cnki.com.cn/Article/CJFDTOTAL-YNJR201922005.htm [7] 娄洪, 杨光, 谢斐. 更好发挥地方政府专项债券的作用[J]. 债券, 2019(8): 7-11. https://www.cnki.com.cn/Article/CJFDTOTAL-ZHQU201908003.htm [8] SAINT PAUL, GILLES. Fiscal policy in an endogenous growth model[J]. The Quarterly Journal of Economics, 1992, 4: 1243-1259. http://qje.oxfordjournals.org/content/107/4/1243.short [9] ROBERT J BARRO, XAVIER SALA-I-MARTIN. Economic growth[M]. New York: Mc Graw-Hill, 1995. [10] ELDER ERICK M. Investment effects of departures from governmental present-value budget balance[J]. Applied Economics, 1999, 31(10): 1239-1247. doi: 10.1080/000368499323454 [11] AHMED H, MILLER S. Crowding-out and crowding-in effects of the components of government expenditure[J]. Contemporary Economic Policy, 2000, 18(1): 124-133. doi: 10.1111/j.1465-7287.2000.tb00011.x [12] REINHART CARMEN M, VINCENT R REINHART, KENNETH S ROGOFF. Public debt overhangs: advanced-economy episodes since1800[J]. Journal of Economic Perspectives, 2012, 26(3): 69-86. doi: 10.1257/jep.26.3.69 [13] 杨文奇, 李艳. 国债挤出效应的实证分析[J]. 山西财经大学学报, 2005(3): 100-103. https://www.cnki.com.cn/Article/CJFDTOTAL-SXCJ200503020.htm [14] 周吉燕. 以政府融资平台为代表的地方政府投融资行为对民间投资的挤出效应研究[J]. 区域金融研究, 2019(8): 76-82. https://www.cnki.com.cn/Article/CJFDTOTAL-GXJR201908015.htm [15] MARIANNE BAXTER, ROBERT G KING. Fiscal policy in general equilibrium[J]. The American Economic Review, 1988, 83(3): 315-334. http://ideas.repec.org/p/roc/rocher/244.html [16] GERHARD GLOMM, B RAVIKUMAR. Public investment in infrastructure in a simple growth model[J]. Journal of Economic Dynamics and Control, 1994, 18(6): 1173-1187. http://www.sciencedirect.com/science/article/pii/0165188994900523 [17] LORA E A. Public investment in infrastructure in Latin America: is debt the culprit?[R]. Inter-American Development Bank Working Paper, 2007. [18] 魏向杰. 政府支出类型和融资方式对私人投资的影响[J]. 经济经纬, 2015(5): 144-149. https://www.cnki.com.cn/Article/CJFDTOTAL-JJJW201505026.htm [19] ASCHAUER D A. Does public capital crowd out private capital?[J]. Journal of Monetary Economice, 1989, 24(2): 171-188. [20] EATON J. Public debt guarantees and private capital flight[J]. The World Bank Economic Review, 1987, 1(3): 377-395. [21] TRAUM N, YANG S C S. When does government debt crowd out investment?[J]. Journal of Applied Econometrics, 2015, 30(1): 24-45. doi: 10.1002/jae.2356 [22] SALOTTI S, TRECROCI C. The impact of government debt, expenditure and taxes on aggregate investment and productivity growth[J]. Economica, 2016, 83(330): 356-384. doi: 10.1111/ecca.12175/full [23] APERE T O. The impact of public debt on private investment in Nigeria: evidence from a nonlinear model[J]. International Journal of Research in Social Sciences, 2014, 4(2): 130-138. http://www.ijsk.org/uploads/3/1/1/7/3117743/16_public_debt___private_investment.pdf [24] 刘震, 蒲成毅. 政府债务、私人投资与经济增长[J]. 贵州财经大学学报, 2014(4): 20-29. https://www.cnki.com.cn/Article/CJFDTOTAL-GZCB201404003.htm [25] 齐红倩, 庄晓季. 我国公共债务对私人投资的影响效应研究[J]. 求索, 2015(4): 56-60. https://www.cnki.com.cn/Article/CJFDTOTAL-QSZZ201504011.htm [26] 陈虹, 杨巧. 政府债务与私人投资的关系研究——OECD国家与中国的比较[J]. 国际金融研究, 2017(12): 17-24. https://www.cnki.com.cn/Article/CJFDTOTAL-GJJR201712002.htm [27] 宋福铁. 国债对于私人投资挤出效应的实证研究[J]. 财经研究, 2004(8): 52-56, 144. https://www.cnki.com.cn/Article/CJFDTOTAL-CJYJ200408005.htm [28] KRUGMAN P. Financing vs. forgiving a debt overhang[J]. Journal of Development Economics, 1988, 29(3): 253-268. [29] OBSTFELD M, ROGOFF K S, WREN-LEWIS S. Foundations of international macroeconomics[M]. Cambridge, MA: MIT Press, 1996. [30] ARSLANALP S, HENRY P B. Is debt relief efficient?[J]. The Journal of Finance, 2005, 60(2): 1017-1051. [31] HELPMAN E. Voluntary debt reduction: incentives and welfare[J]. Staff Papers, 1989, 36(3): 580-611. [32] 吴俊培, 张斌. 积极财政政策挤入效应的实证分析[J]. 财贸经济, 2013(7): 5-16. https://www.cnki.com.cn/Article/CJFDTOTAL-CMJJ201307003.htm [33] 陆正飞, 何捷, 窦欢. 谁更过度负债: 国有还是非国有企业?[J]. 经济研究, 2015(12): 54-67. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ201512015.htm -

下载:

下载: