Can Informatization of Tax Enforcement Reduce the Uncertainty of Enterprise Taxation?Evidence from A Quasi-natural Experiment on the "Third Phase of Golden Tax Project"

-

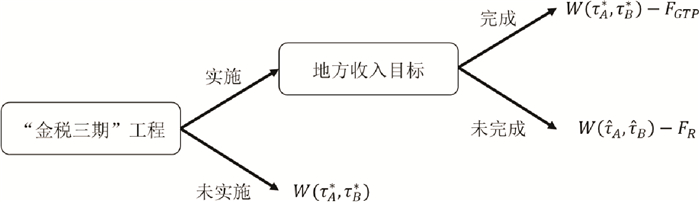

摘要: 征管信息化通过压缩税收自由裁量空间提高了税收征管的规范性,并有助于降低企业税收的不确定性。在借鉴最优直接税制度模型的基础上,构建相应的理论模型以揭示征管信息化降低企业税收不确定性的作用机制,并进一步基于金税三期工程实施的准自然实验,利用我国上市公司面板数据和连续性双重差分法进行实证分析,从微观层面考察征管信息化对企业税收不确定性的影响。研究发现:金税三期工程的实施显著降低了企业税收的不确定性,尤其体现于民营企业;当地方面临较大的财政增收压力时,征管信息化对税收不确定性的抑制效应被削弱;宏观层面的拓展性分析表明,金税三期工程的实施提高了地区内企业税负的均等化水平。本研究为优化税收营商环境、深化税收征管体制改革提供了政策启示。Abstract: Informatization of tax enforcement improve the standardization of tax collection and management by reducing tax discretionary space, it helps reduce corporate tax uncertainty. Though constructing a theoretical model based on the theory of optimal direct tax system, this paper aims to reveal the mechanism by which informatization of tax enforcement reduces the corporate tax uncertainty. Based on the Quasi-natural experiment based on the implementation of "Third Phase of Golden Tax Project", this study employs the panel data of Chinese listed companies and the continuous difference-in-differences method to examine the impact of informationization of tax enforcement on the uncertainty of enterprise taxation at the micro level. It is found that the implementation of "Third Phase of Golden Tax Project" has significantly reduced the uncertainty of corporate tax revenue, especially for private enterprises; in addition, when local governments face greater pressures to increase fiscal revenues, the inhibitory effect of informatization of tax enforcement on taxation uncertainty is weakened. An expansive analysis at the macro level shows that the implementation of "Third Phase of Golden Tax Project" has improved the level of equalization of corporate tax burdens in the region. The findings of this study provide policy enlightenment for optimizing business environment in taxation and deepening the reform of tax collection and management system.

-

表 1 金税三期工程对企业税收不确定性的影响

情况 说明 企业实际税负 实际税负偏离的程度 Ⅰ 最优征税决策仍在偏离范围内(τA*≥$\tilde{\tau}_A $且τB*≤$\hat{\tau}_B $) (τA*, τB*) 不受影响 Ⅱ 企业A存在的“短收”已超过偏离范围(τA* < $\tilde{\tau}_A $) ($\tilde{\tau}_A $, R-$\tilde{\tau}_A $) 缩小 Ⅲ 企业B面临的税收“超收”已超过偏离范围(τB*>$\hat{\tau}_B $) (R-$\hat{\tau}_B $, $\hat{\tau}_B $) 缩小 Ⅳ 企业A的与企业B的税负均已超过偏离范围(τA* < $\tilde{\tau}_A $且τB*>$\hat{\tau}_B $) ($\tilde{\tau}_A $, R-$\tilde{\tau}_A $)或(R-$\hat{\tau}_B $, $\hat{\tau}_B $) 缩小 表 2 变量定义与描述性统计结果

变量名称 变量定义 均值 标准差 最小值 最大值 TF_tt 企业总税负不确定性 18.95 1.184 10.94 22.79 TF_cit 企业所得税税负不确定性 17.69 1.207 10.07 21.83 GTP 金税三期工程虚拟变量 0.151 0.358 0 1 lnprofit 企业利润总额的对数 18.71 1.459 10.50 23.64 lnsales 企业营业收入的对数 21.37 1.319 17.37 25.66 roa 企业资产收益率 0.046 7 0.037 5 -0.012 5 0.210 lnsize 企业总资产的对数 21.95 1.140 19.15 26.24 lnfixed 企业固定资产净额的对数 24.05 15.73 0.205 72.96 inventr 存货资产比(%) 16.29 13.62 0.040 0 74.13 lev 企业资产负债比 0.441 0.202 0.052 1 1.010 cash 现金资产比 0.219 0.162 0.004 27 1.117 lnpopu 地级市总人口的对数 6.200 0.617 3.635 8.129 lnopen 地级市外资使用额的对数 11.73 1.563 3.219 14.15 lnfixinv 地级市固定资产投资额的对数 16.88 0.835 13.44 18.97 grpgr 地级市国内生产总值增长率(%) 10.66 5.290 -19.38 109 dycy 第一产业产值占比(%) 6.070 5.462 0.030 0 42.93 decy 第二产业产值占比(%) 48.31 8.051 18.67 89.75 注:统计的样本范围是企业总税负不确定性TF_tt对其余变量做回归(见表 3第(4)列)所使用到的样本,共计10 017个观测值。 表 3 基本回归结果

变量 (1) (2) (3) (4) (5) (6) TF_tt TF_tt TF_tt TF_cit TF_cit TF_cit GTP -0.103 9*** -0.099 4*** -0.092 0** -0.119 6*** -0.120 9*** -0.118 1*** (0.038 0) (0.038 1) (0.039 1) (0.041 6) (0.041 5) (0.042 1) lnprofit -0.022 2 -0.021 1 -0.142 5*** -0.142 6*** (0.029 1) (0.029 2) (0.027 2) (0.027 3) lnsales 0.028 7 0.038 2 -0.103 2** -0.099 0* (0.048 6) (0.048 5) (0.051 7) (0.051 4) roa 0.755 9 0.781 9 3.502 3*** 3.513 7*** (0.803 0) (0.797 6) (0.827 4) (0.824 3) lnsize 0.103 0 0.100 0 0.237 7*** 0.237 3*** (0.063 8) (0.063 4) (0.067 2) (0.067 3) lnfixed 0.007 1*** 0.007 1*** 0.003 2* 0.003 2* (0.001 8) (0.001 8) (0.001 7) (0.001 7) inventr 0.006 9*** 0.007 2*** 0.008 0*** 0.008 2*** (0.002 5) (0.002 5) (0.002 4) (0.002 4) lev 0.090 3 0.080 4 -0.011 5 -0.020 5 (0.147 3) (0.147 0) (0.150 3) (0.150 1) cash 0.241 0*** 0.247 0*** 0.014 3 0.018 6 (0.090 8) (0.091 1) (0.091 1) (0.091 4) lnpopu -0.348 2 -0.028 9 (0.245 9) (0.275 7) grpgr 0.003 7*** 0.002 0 (0.001 2) (0.001 8) dycy 0.045 1** 0.016 0 (0.020 3) (0.020 0) decy -0.007 5 -0.007 4 (0.006 8) (0.006 6) lnfixinv 0.058 0 -0.021 1 (0.069 2) (0.079 5) lnopen -0.005 3 -0.009 0 (0.023 9) (0.027 2) Constant 18.879 7*** 16.050 8*** 17.162 6*** 17.650 8*** 16.918 9*** 17.691 0*** (0.034 8) (1.035 0) (2.011 6) (0.036 7) (1.093 7) (2.322 7) Obs. 10 176 10 043 10 043 10 150 10 017 10 017 R-squared 0.005 6 0.013 3 0.016 6 0.002 1 0.012 3 0.013 3 Firm FE YES YES YES YES YES YES Year FE YES YES YES YES YES YES 注:* * *、* *、*分别表示在1%、5%和10%的水平上显著,括号内是稳健标准误。下表同。 表 4 企业所有权性质异质性分析结果

变量 国企 国企 民企 民企 TF_tt TF_cit TF_tt TF_cit GTP -0.033 3 -0.074 8 -0.157 9*** -0.1438*** (0.054 7) (0.058 6) (0.046 1) (0.049 0) Observations 4 459 4 442 5 717 5 708 R-squared 0.031 8 0.028 0 0.026 2 0.025 8 Control YES YES YES YES Firm FE YES YES YES YES Year FE YES YES YES YES 表 5 安慰剂检验结果

变量 (1) (2) (3) (4) (5) (6) TF_tt TF_tt TF_tt TF_cit TF_cit TF_cit _GTP3 0.045 4 0.038 9 (0.036 5) (0.039 8) _GTP2 0.005 0 0.022 3 (0.037 5) (0.038 5) _GTP1 0.017 7 -0.006 0 (0.033 2) (0.034 7) Observations 10 176 10 176 10 176 10 150 10 150 10 150 R-squared 0.017 7 0.017 6 0.017 6 0.016 4 0.016 3 0.016 3 Control YES YES YES YES YES YES Firm FE YES YES YES YES YES YES Year FE YES YES YES YES YES YES 表 6 地区财政增收压力异质性分析结果

变量 (1) (2) (3) (4) (5) (6) TF_tt TF_cit TF_tt TF_cit TF_tt TF_cit GTP -0.281 2*** -0.329 4*** -0.202 7** -0.203 3** -0.471 4*** -0.579 2*** (0.101 0) (0.102 1) (0.081 8) (0.082 1) (0.180 1) (0.180 9) taxplan -0.004 3 0.000 1 (0.004 4) (0.004 5) GTP×taxplan 0.021 0** 0.019 9** (0.009 2) (0.009 3) transp -0.000 1 0.000 2 (0.000 3) (0.000 3) GTP×transp 0.001 0* 0.000 6 (0.000 6) (0.000 6) nontaxr -0.002 3 0.000 9 (0.004 4) (0.004 4) GTP×nontaxr 0.012 7** 0.014 7** (0.005 8) (0.005 8) Observations 9 455 9 432 9 910 9 884 9 910 9 884 R-squared 0.019 7 0.037 9 0.018 3 0.037 1 0.018 6 0.037 7 Control YES YES YES YES YES YES Firm FE YES YES YES YES YES YES Year FE YES YES YES YES YES YES 表 7 作用渠道检验结果

变量 TF_tt TF_cit GTP -0.011 8(0.051 3) -0.073 8(0.051 1) OT_tt 0.111 5*(0.058 3) GTP×OT_tt -0.1678**(0.068 9) OT_cit 0.098 2*(0.051 4) GTP×OT_cit -0.1461**(0.068 5) Observations 9 910 9 884 R-squared 0.019 9 0.038 4 Control YES YES Firm FE YES YES Year FE YES YES 表 8 金税三期工程对税负公平的影响

变量 (1) (2) CV_tt CV_cit GTP -0.008 3*(0.004 5) -0.008 7*(0.004 6) LNGDPPC -0.045 3*(0.024 3) -0.045 1*(0.024 8) SIGDP 0.001 0(0.001 2) 0.001 0(0.001 2) TIGDP 0.001 4(0.001 3) 0.001 3(0.001 4) LNPOPU -0.100 3**(0.050 7) -0.102 3**(0.051 8) LNINVEST 0.015 6(0.009 5) 0.015 9(0.009 7) LNFDI 0.008 8(0.005 5) 0.008 7(0.005 6) URBAN -0.002 2**(0.001 0) -0.002 1**(0.001 0) Constant 1.157 8**(0.505 4) 1.174 0**(0.516 2) Observations 270 270 R-squared 0.090 0 0.086 5 Province FE YES YES Year FE YES YES 注:样本是除西藏外30个省市自治区2008—2016年的面板数据,采用省级层面人均GDP(LNGDPPC)、第二产业占GDP比值(SIGDP)、第三产业占GDP比值(TIGDP)、人口数(LNPOPU)、固定资产投资(LNINVEST)、FDI(LNFDI)以及城镇化率(URBAN)作为拓展性分析的控制变量。 -

[1] 高培勇. 中国税收持续高速增长之谜[J]. 经济研究, 2006(12): 13-23. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ200612002.htm [2] 田彬彬, 陶东杰, 李文健. 税收任务、策略性征管与企业实际税负[J]. 经济研究, 2020(8): 121-136. doi: 10.3969/j.issn.1002-5863.2020.08.031 [3] NIEMANN R. The impact of tax uncertainty on irreversible investment[J]. Review of Managerial Science, 2011, 5(1): 1-17. doi: 10.1007/s11846-010-0042-5 [4] 甘行琼, 靳毓. 税收不确定性研究进展[J]. 经济学动态, 2020(6): 123-135. https://www.cnki.com.cn/Article/CJFDTOTAL-JJXD202006009.htm [5] HASSETT K A, METCALF M E. Investment with uncertain tax policy: does random tax policy discourage investment?[J]. The Economic Journal, 1999, 457(109): 372-393. [6] AIZENMAN J, MARION N P. Policy uncertainty, persistence and growth[J]. International Review of Economics, 1993, 1(2): 145-163. doi: 10.1111/j.1467-9396.1993.tb00012.x [7] RATHELOT R, SILLARD P. The importance of local corporate taxes in business location decisions: evidence from French micro data[J]. The Economic Journal, 2008, 527(118): 499-514. [8] ROHLIN S, ROSENTHAL S S, ROSS A. Tax avoidance and business location in a state border model[J]. Journal of Urban Economics, 2014, 83: 34-49. doi: 10.1016/j.jue.2014.06.003 [9] GIROUD X, RAUH J. State taxation and the reallocation of business activity: evidence from establishment-level data[J]. Journal of Political Economy, 2019, 127: 1262-1316. doi: 10.1086/701357 [10] LEE J, XU J H. Tax uncertainty and business activity[J]. Journal of Economic Dynamics & Control, 2019, 103: 158-184. [11] ALM J. Uncertain tax policies, individual behavior, and welfare[J]. American Economic Review, 1988, 78(1): 237-245. [12] SKINNER J. The welfare cost of uncertain tax policy[J]. Journal of Public Economics, 1988, 37(2): 129-145. doi: 10.1016/0047-2727(88)90067-9 [13] 亚当·斯密. 国富论[M]. 郭大力, 王亚楠, 译. 北京: 商务印书馆, 2015: 792. [14] ZANGARI E, CAIUMI A, HEMMELGARN T. Tax uncertainty: economic evidence and policy responses[R]. European Commission, Directorate General Taxation and Customs Union, Working Paper, 2017, No. 67. [15] 范子英, 田彬彬. 税收竞争、税收执法与企业避税[J]. 经济研究, 2013(9): 99-111. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ201309008.htm [16] 吕冰洋, 马光荣, 毛捷. 分税与税率: 从政府到企业[J]. 经济研究, 2016(7): 13-28. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ201607003.htm [17] 吕冰洋, 郭庆旺. 中国税收高速增长的源泉: 税收能力和税收努力框架下的解释[J]. 中国社会科学, 2011(2): 76-90. https://www.cnki.com.cn/Article/CJFDTOTAL-ZSHK201102009.htm [18] FRANZONI L A. Discretion in tax enforcement[J]. Economica, 2004, 283(71): 369-389. [19] 杨武, 李升. 税收征管不确定性与外商直接投资: 促进还是抑制[J]. 财贸经济, 2019(11): 50-65. https://www.cnki.com.cn/Article/CJFDTOTAL-CMJJ201911005.htm [20] DYRENG S D, HANLON M, MAYDEW E L. When does tax avoidance result in tax uncertainty?[J]. Accounting Review, 2019, 94(2): 179-203. [21] 张馨予. 数字经济对增值税税收遵从的挑战与应对——欧盟最新税改策略分析与启示[J]. 西部论坛, 2020(6): 113-121. [22] KUMLER T, VERHOOGEN E, FRíAS J. Enlisting employees in improving payroll-tax compliance: evidence from Mexico[J]. Review of Economics and Statistics, 2020, 102(5): 881-896. [23] 张之乐. 以区块链技术促进纳税遵从的设想[J]. 税务研究, 2017(12): 108-111. https://www.cnki.com.cn/Article/CJFDTOTAL-SWXH201712027.htm [24] 蔡昌, 赵艳艳, 戴梦妤. 基于区块链技术的税收征管创新研究[J]. 财政研究, 2019(10): 114-127. https://www.cnki.com.cn/Article/CJFDTOTAL-CZYJ201910010.htm [25] 李艳, 杨婉昕, 陈斌开. 税收征管、税负水平与税负公平[J]. 中国工业经济, 2020(11): 24-41. https://www.cnki.com.cn/Article/CJFDTOTAL-GGYY202011003.htm [26] 孙雪娇, 翟淑萍, 于苏. 大数据税收征管如何影响企业盈余管理?——基于"金税三期"准自然实验的证据[J]. 会计研究, 2021(1): 67-81. https://www.cnki.com.cn/Article/CJFDTOTAL-KJYJ202101006.htm [27] 张克中, 欧阳洁, 李文健. 缘何"减税难降负": 信息技术、征税能力与企业逃税[J]. 经济研究, 2020(3): 116-132. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ202003011.htm [28] 刘慧龙, 张玲玲, 谢婧. 税收征管数字化升级与企业关联交易治理[J]. 管理世界, 2022(6): 158-175. https://www.cnki.com.cn/Article/CJFDTOTAL-GLSJ202206007.htm [29] 樊勇, 李昊楠. 税收征管、纳税遵从与税收优惠——对金税三期工程的政策效应评估[J]. 财贸经济, 2020(5): 51-66. https://www.cnki.com.cn/Article/CJFDTOTAL-CMJJ202005005.htm [30] SALANIE B. The economics of taxation[M]. Cambridge, MA: MIT press, 2011. [31] MIRRLEES J A. An exploration in the theory of optimum income taxation[J]. The Review of Economic Studies, 1971, 38(2): 175-208. [32] EBERT U. A re-examination of the optimal nonlinear income tax[J]. Journal of Public Economics, 1992, 49(1): 47-73. [33] 白云霞, 唐伟正, 刘刚. 税收计划与企业税负[J]. 经济研究, 2019(5): 98-112. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ201905008.htm [34] EDMISTON K D. Tax uncertainty and investment: a cross-country empirical examination[J]. Economic Inquiry, 2004, 42(3): 425-440. [35] 范子英, 王倩. 财政补贴的低效率之谜: 税收超收的视角[J]. 中国工业经济, 2019(12): 23-41. https://www.cnki.com.cn/Article/CJFDTOTAL-GGYY201912003.htm [36] FERRARA E L, CHONG A, DURYEA S. Soap operas and fertility: evidence from Brazil[J]. American Economic Journal: Applied Economics, 2012, 4(4): 1-31. -

下载:

下载: