On Executives' High-quality Ecological Environment Experience and Corporate Green Innovation

-

摘要: 自然生态环境是对人的心理特质有决定性塑造作用的最早期、最直接的因素。基于高阶理论和烙印理论,手工搜集整理了2003—2020年中国A股上市公司高管经历的独特数据集,对高管高质量生态环境经历与企业绿色创新的影响机理和情境因素进行研究,结果表明:高管的高质量生态环境经历与企业的绿色创新水平正相关,且企业董事会女性成员的比例、融资约束程度和企业所在地的生态环境质量对二者的关系具有调节作用。本文拓展了企业绿色创新的研究视角,增强了高阶理论和烙印理论的解释力度,并为企业高层次人才的招聘和选拔以及制度安排提供了新的证据支持。Abstract: The ecological environment is the earliest and most direct factor that has a decisive role in shaping human psychological traits. Based on upper echelons theory and imprinting theory, this paper explores the impact of executives' high-quality ecological environment experience on corporate green innovation with the unique dataset of high-quality ecological experience of the executives from Shanghai and Shenzhen A-share listed companies from 2003 to 2020. The results show that high-quality ecological environment experience of executives is positively related to the level of green innovation of enterprises, and the proportion of female board members, the degree of financing constraints and the quality of the ecological environment where the enterprise is located moderate the relationship. The findings expand the research perspective of corporate green innovation, and increase the explanatory power of upper echelons theory and imprinting theory. In practice, this research provides new evidence for the recruitment and selection of high-level talents and institutional arrangements in enterprises.

-

表 1 主要变量的定义和测量

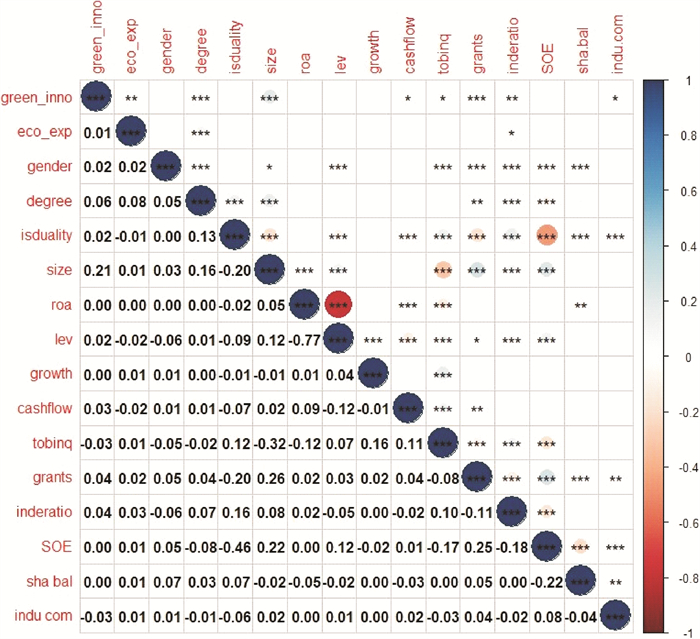

变量类型 变量 定义及测量 被解释变量 绿色创新(green_inno) 企业绿色专利数量 解释变量 高管高质量生态环境经历(eco_exp) CEO出生地距离最近的保护区距离的倒数 控制变量 年龄(age) CEO的年龄 性别(gender) 若CEO为男性,赋值为1,否则为0 学历(degree) 1=中专及中专以下,2=大专,3=本科,4=硕士研究生,5=博士研究生 董事长和总经理两职合一(isduality) 董事长、总经理为一人同时担任赋值为1,否则为0 企业规模(size) 年末总资产的自然对数 盈利能力(roa) 资产收益率,企业净利润与资产比值 财务杠杆(lev) 企业的资产负债率表示企业的财务杠杆,财务杠杆=长期负债/总资产的比率 企业成长性(growth) 主营业务收入增长率 经营活动现金流量(cashflow) 经营活动产生的现金流量净额与企业资产的比值 托宾q(tobinq) (股票市值+净债务)/净资产 企业专利数量(patents) 企业当年申请的专利总数 独立董事比例(inderatio) 独立董事占董事会总人数的比例×100 产权性质(SOE) 控股股东为国有企时定义为1,否则为0 股权制衡(sha_bal) 以第二至第十大股东持股比例之和与第一大股东持股比例的比值得到 行业竞争程度(indu_com) 利用单个企业营业收入计算其所占行业市场份额 调节变量 董事会女性成员(femaleratio) 董事会中女性成员的比例 企业融资约束(cap_rat) 按照KZ方法,使用企业规模(size)和企业年龄(age)两个强外生性的变量构建SA指数: -0.737×size+0.043×size2-0.04×age 企业所在地的生态环境质量(eco_quality) 企业注册地与最近的自然保护区的距离 注:由作者整理获得,下表同。 表 2 变量的描述性统计

变量 Mean p25 p75 Sd Min Max green_inno 0.442 0 0 3.377 0 126 eco_exp 0.021 0.011 0.02 0.027 0.004 0.425 age 47.79 44 52 5.758 29 64 gender 0.954 1 1 0.209 0 1 degree 3.749 3 4 1.248 1 7 isduality 0.375 0 1 0.484 0 1 size 10.64 9.541 11.49 1.470 5.731 17.03 roa 0.0340 0.0140 0.0680 0.349 -20.55 1.992 lev 0.472 0.295 0.620 0.435 0.0160 20.25 growth 0.466 0 0.325 7.933 -0.995 461.0 cashflow 0.05 0.007 0.094 0.079 -0.393 0.461 tobinq 2.024 1.186 2.285 1.543 0.711 25.33 grants 40.97 3 23 125.5 1 1774 inderatio 0.376 0.333 0.429 0.0750 0 0.800 SOE 0.460 0 1 0.498 0 1 sha_bal 1.850 1.258 2.243 0.781 1.007 7.565 indu com 0.226 0.0610 0.286 0.261 0.0140 1 表 3 CEO的高质量生态环境经历对绿色创新影响的回归结果

变量 (1)

green_inno(2)

green_inno(3)

green_inno(4)

green_innoeco_exp 17.55***(4.95) 22.55***(5.16) 32.06***(6.05) 35.05***(5.36) age 0.146***(18.60) 0.367***(2.33) gender -1.304(-1.10) -2.251*(-1.77) degree 0.0977**(2.08) 0.0633(1.27) isduality 0.670***(4.08) 0.402(1.57) size 0.681***(6.75) roa 0.974(1.18) lev -0.186(-0.39) growth -0.174(-1.60) cashflow 2.552***(4.02) tobinq 0.163***(3.77) grants 0.0581***(3.26) inderatio 0.619(1.22) SOE -0.408(-0.88) sha bal -0.235**(-2.09) indu com -0.608***(-5.00) 行业变量 未控制 控制 控制 控制 年度变量 未控制 控制 控制 控制 样本量 1 187 1 187 1 187 1 187 注:括号内为t值,*、**和***分别表示p < 0.1, p < 0.05, p < 0.01,下表同。 表 4 董事会女性成员对CEO的高质量生态环境经历与绿色创新关系的调节作用

变量 (1)

green_inno(2)

green_inno(3)

green_inno(4)

green_innoeco_exp 11.93***(5.14) 15.02***(3.07) 5.985(0.92) 64.79***(4.04) femaleratio 1.193**(2.42) 0.657(1.19) 1.194*(1.90) 0.726(0.92) eco_exp×femaleratio 0.042 0***(10.42) 0.021 7***(3.82) 0.014 3***(2.90) 0.018 4***(2.65) age 0.227***(17.08) 0.754***(4.04) gender 16.27(0.01) 23.04(0.01) degree 0.037 2(0.44) 0.038 6(0.42) isduality 0.412(1.51) -0.538(-0.96) size 1.215***(6.73) roa 2.457**(2.01) lev 0.188(0.25) growth -0.295(-1.61) cashflow -1.256(-1.25) tobinq 0.013 4(0.21) grants 0.066 1***(2.61) inderatio 0.184(0.24) SOE -0.387(-0.70) sha bal -0.036 1(-0.26) indu com 0.329*(1.84) 行业变量 未控制 控制 控制 控制 年度变量 未控制 控制 控制 控制 样本数 1 187 1 187 1 187 1 187 表 5 企业融资约束对CEO的高质量生态环境经历与绿色创新关系的调节作用

变量 (1)

green_inno(2)

green_inno(3)

green_inno(4)

green_innoeco_exp 19.53***(4.15) 6.646(1.41) 18.68***(2.90) 44.67***(2.63) cap_rat -0.300***(-10.26) -0.145***(-4.08) -0.133***(-3.79) -0.0575*(-1.88) eco_exp×cap_rat -0.536***(-16.11) -0.468***(-12.53) -0.392***(-11.11) -0.424***(-7.23) age 0.198***(12.64) 0.521***(2.58) gender 13.67(0.04) 19.10(0.01) degree 0.218**(2.46) 0.0464(0.49) isduality 0.389(1.23) -1.190(-1.52) size 0.595***(2.66) roa 1.635(1.03) lev -0.366(-0.39) growth -0.0430(-0.21) cashflow 4.602***(2.91) tobinq 0.013 6(0.13) grants 0.027 3(0.88) inderatio -1.517(-1.64) SOE -0.222(-0.38) sha bal 0.062 3(0.39) indu com 0.086 1(0.42) 行业变量 未控制 控制 控制 控制 年度变量 未控制 控制 控制 控制 样本数 1 187 1 187 1 187 1 187 表 6 企业所在地生态环境质量对CEO的高质量生态环境经历与绿色创新关系的调节作用

变量 (1)

green_inno(2)

green_inno(3)

green_inno(4)

green_innoeco_exp 2.17***(4.60) 2.35***(4.73) 1.65**(2.41) 4.70***(3.99) eco_quality 0.040 2***(11.30) 0.060 9*(1.65) 0.018 4***(3.92) 0.083 6(1.28) eco_exp×eco_quality 0.198 3***(7.59) 0.783***(2.74) 0.123 6***(4.53) 0.206 5***(4.38) age 0.216***(16.71) 0.748***(4.05) gender 14.68(0.02) 22.81(0.01) degree 0.055 6(0.66) 0.044 8(0.49) isduality 0.451*(1.73) -0.648(-1.16) size 1.292***(6.70) roa 2.885**(2.35) lev 0.073 9(0.10) growth -0.347*(-1.82) cashflow 1.466(1.46) tobinq -0.028 7(-0.46) grants 0.070 0***(2.77) inderatio 0.261(0.34) SOE -0.285(-0.49) sha bal -0.070 7(-0.49) indu com -0.386(-1.54) 行业变量 未控制 控制 控制 控制 年度变量 未控制 控制 控制 控制 样本数 1 187 1 187 1 187 1 187 表 7 Heckman二阶段模型回归结果

变量 (1)

green_inno(2)

green_inno(3)

green_inno(4)

green_innoeco_exp 56.45***(3.57) 125.1***(4.81) 44.90***(2.64) 65.22***(3.99) λ -24.53(-0.28) -42.67(-0.49) -17.14(-0.18) -23.98(-0.27) femaleratio 0.809***(3.02) eco_ exp×femaleratio 7.610***(3.31) cap_rat -0.056 2(-0.76) eco_exp×cap_rat -0.423***(-7.15) eco_quality 0.008 27*(1.77) eco_exp×eco_quality 20.63***(4.38) age 0.729***(3.95) 0.725***(3.87) 0.522***(2.59) 0.751***(4.06) gender 22.43(0.01) 22.56(0.01) 19.10(0.01) 22.82(0.01) degree 0.041 0(0.45) 0.025 3(0.28) 0.047 1(0.50) 0.046 1(0.50) isduality -0.615(-1.10) -0.422(-0.74) -1.193(-1.52) -0.650(-1.16) size 1.264***(6.93) 1.344***(7.31) 0.600***(2.66) 1.297***(6.70) roa 3.622(0.16) 8.418(0.37) 2.828(0.11) 3.352(0.15) lev 6.448(0.27) 11.47(0.48) 4.314(0.17) 6.594(0.28) growth -0.393(-0.76) -0.471(-0.92) -0.139(-0.24) -0.477(-0.93) cashflow 2.836(0.56) 3.808(0.75) 5.571(1.00) 2.829(0.56) tobinq 0.084 5(0.24) 0.152(0.43) 0.080 7(0.21) 0.065 7(0.19) grants 0.360(0.35) 0.503(0.50) 0.227(0.21) 0.349(0.34) inderatio -8.665(-0.27) -15.07(-0.47) -7.819(-0.22) -8.534(-0.26) SOE -0.717(-0.44) -0.962(-0.58) -0.529(-0.30) -0.705(-0.43) sha bal -0.077 2(-0.54) -0.098 7(-0.70) 0.057 9(0.36) -0.075 2(-0.52) indu com 0.304*(1.70) 0.141(0.75) 0.089 9(0.44) -0.382(-1.52) 行业变量 未控制 控制 控制 控制 年度变量 未控制 控制 控制 控制 样本数 1 187 1 187 1 187 1 187 表 8 CEO高质量生态环境经历对其所在企业绿色创新影响的稳健性回归结果

变量 (1)

green_inno(2)

green_inno(3)

green_inno1(4)

green_inno1eco_area 6.711***(3.73) 13.67***(2.72) eco_exp 17.55***(4.95) 29.26***(3.87) age 0.322***(3.07) 0.099 7(1.40) gender 14.25(0.00) -1.857(-1.48) degree 0.010 5(0.12) 0.049 1(0.97) isduality -0.652(-1.18) 0.420(1.62) size 1.278***(7.04) 0.645***(6.18) roa 2.595**(2.13) 1.051(1.27) lev -0.235(-0.32) -0.144(-0.30) growth -0.253(-1.41) -0.167(-1.54) cashflow 1.364(1.37) 2.638***(4.13) tobinq -0.015 6(-0.25) 0.156***(3.59) grants 0.068 3***(2.72) 0.058 3***(3.27) inderatio 0.488(0.65) 0.613(1.21) SOE -0.879*(-1.66) -0.378(-0.81) sha bal -0.083 8(-0.59) -0.222**(-1.97) indu com 0.301*(1.68) 0.608***(4.99) 行业变量 未控制 控制 控制 控制 年度变量 未控制 控制 控制 控制 样本数 1 187 1 187 1 187 1 187 -

[1] 王彩明, 李健. 中国区域绿色创新绩效评价及其时空差异分析——基于2005-2015年的省际工业企业面板数据[J]. 科研管理, 2019(6): 29-42. https://www.cnki.com.cn/Article/CJFDTOTAL-KYGL201906004.htm [2] RENNINGS K. Redefining innovation-eco-innovation research and the contribution from ecological economics[J]. Ecological Economics, 2000, 32(2): 319-332. doi: 10.1016/S0921-8009(99)00112-3 [3] BERNAUER T, ENGEL S, KAMMERER D, et al. Explaining green innovation: ten years after Porter's win-win proposition: how to study the effects of regulation on corporate environmental innovation?[J]. Politische Vierteljahresschrift, 2007, 39: 323-341. [4] 杜龙政, 赵云辉, 陶克涛, 等. 环境规制, 治理转型对绿色竞争力提升的复合效应——基于中国工业的经验证据[J]. 经济研究, 2019(10): 106-120. doi: 10.3969/j.issn.1002-5863.2019.10.031 [5] 方先明, 那晋领. 创业板上市公司绿色创新溢酬研究[J]. 经济研究, 2020(10): 106-123. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ202010008.htm [6] LEITER A M, PAROLINI A, WINNER H. Environmental regulation and investment: evidence from European industry data[J]. Ecological Economics, 2011, 70(4): 759-770. doi: 10.1016/j.ecolecon.2010.11.013 [7] 李青原, 肖泽华. 异质性环境规制工具与企业绿色创新激励——来自上市企业绿色专利的证据[J]. 经济研究, 2020(9): 192-208. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ202009013.htm [8] 李春发, 卢娜娜, 李冬冬, 等. 企业绿色创新: 政府规制、信息披露及投资策略演化[J]. 科学学研究, 2021(1): 180-192. https://www.cnki.com.cn/Article/CJFDTOTAL-KXYJ202101020.htm [9] FREUDENREICH B, LVDEKE-FREUND F, SCHALTEGGER S. A stakeholder theory perspective on business models: value creation for sustainability[J]. Journal of Business Ethics, 2020, 166(1): 3-18. doi: 10.1007/s10551-019-04112-z [10] CHENG H K, FAN W, GUO P, et al. Can "gold medal" online sellers earn gold? the impact of reputation badges on sales[J]. Journal of Management Information Systems, 2020, 37(4): 1099-1127. doi: 10.1080/07421222.2020.1831776 [11] SHAFIQ M, LASRADO F, HAFEEZ K. The effect of TQM on organisational performance: empirical evidence from the textile sector of a developing country using SEM[J]. Total Quality Management & Business Excellence, 2019, 30(1-2): 31-52. [12] 曹洪军, 陈泽文. 内外环境对企业绿色创新战略的驱动效应——高管环保意识的调节作用[J]. 南开管理评论, 2017(6): 95-103. doi: 10.3969/j.issn.1008-3448.2017.06.010 [13] 陈泽文, 陈丹. 新旧动能转换的环境不确定性背景下高管环保意识风格如何提升企业绩效——绿色创新的中介作用[J]. 科学学与科学技术管理, 2019(10): 113-128. https://www.cnki.com.cn/Article/CJFDTOTAL-KXXG201910008.htm [14] 潘爱玲, 刘昕, 邱金龙, 等. 媒体压力下的绿色并购能否促使重污染企业实现实质性转型[J]. 中国工业经济, 2019(2): 174-192. https://www.cnki.com.cn/Article/CJFDTOTAL-GGYY201902011.htm [15] MARQUIS C, TILCSIK A. Imprinting: toward a multilevel theory[J]. Academy of Management Annals, 2013, 7(1): 195-245. doi: 10.5465/19416520.2013.766076 [16] 毕茜, 李虹媛, 于连超. 高管环保经历嵌入对企业绿色转型的影响与作用机制[J]. 广东财经大学学报, 2019(5): 4-21. https://xb.gdufe.edu.cn/article/id/98b9c2a8-b4cc-4b51-9f17-f3bfa8a330ad [17] ALLEN S, CUNLIFFE A L, EASTERBY-SMITH M. Understanding sustainability through the lens of ecocentric radical-reflexivity: implications for management education[J]. Journal of Business Ethics, 2019, 154(3): 781-795. doi: 10.1007/s10551-016-3420-3 [18] EVANS G W, OTTO S, KAISER F G. Childhood origins of young adult environmental behavior[J]. Psychological Science, 2018, 29(5): 679-687. doi: 10.1177/0956797617741894 [19] BOIRAL O, HERAS-SAIZARBITORIA I, BROTHERTON M C. Nature connectedness and environmental management in natural resources companies: an exploratory study[J]. Journal of Cleaner Production, 2019, 206: 227-237. doi: 10.1016/j.jclepro.2018.09.174 [20] 权小锋, 醋卫华, 徐星美. 高管从军经历与公司盈余管理: 军民融合发展战略的新考察[J]. 财贸经济, 2019(1): 98-113. https://www.cnki.com.cn/Article/CJFDTOTAL-CMJJ201901008.htm [21] 宋建波, 文雯, 王德宏. 海归高管能促进企业风险承担吗——来自中国A股上市公司的经验证据[J]. 财贸经济, 2017(12): 111-126. doi: 10.3969/j.issn.1002-8102.2017.12.008 [22] 张晓亮, 杨海龙, 唐小飞. CEO学术经历与企业创新[J]. 科研管理, 2019(2): 154-163. https://www.cnki.com.cn/Article/CJFDTOTAL-KYGL201902016.htm [23] DEVILLE N V, TOMASSO L P, STODDARD O P, et al. Time spent in nature is associated with increased pro-environmental attitudes and behaviors[J]. International Journal of Environmental Research and Public Health, 2021, 18(14): 7498. doi: 10.3390/ijerph18147498 [24] WOLF J. The relationship between sustainable supply chain management, stakeholder pressure and corporate sustainability performance[J]. Journal of Business Ethics, 2014, 119(3): 317-328. doi: 10.1007/s10551-012-1603-0 [25] HERRMANN P, NADKARNI S. Managing strategic change: the duality of CEO personality[J]. Strategic Management Journal, 2014, 35(9): 1318-1342. doi: 10.1002/smj.2156 [26] HAHN T, PREUSS L, PINKSE J, et al. Cognitive frames in corporate sustainability: managerial sensemaking with paradoxical and business case frames[J]. Academy of Management Review, 2014, 39(4): 463-487. doi: 10.5465/amr.2012.0341 [27] LEONG L Y C, FISCHER R, MCCLURE J. Are nature lovers more innovative? the relationship between connectedness with nature and cognitive styles[J]. Journal of Environmental Psychology, 2014, 40: 57-63. doi: 10.1016/j.jenvp.2014.03.007 [28] CHEEK N N, NOREM J K. Are big five traits and facets associated with anchoring susceptibility?[J]. Social Psychological and Personality Science, 2020, 11(1): 26-35. doi: 10.1177/1948550619837001 [29] WHITEMAN G, COOPER W H. Ecological embeddedness[J]. Academy of Management Journal, 2000, 43(6): 1265-1282. [30] 于飞, 胡泽民, 董亮, 等. 知识耦合对企业突破式创新的影响机制研究[J]. 科学学研究, 2018(12): 2292-2304. doi: 10.3969/j.issn.1003-2053.2018.12.026 [31] NISBET E K, ZELENSKI J M, MURPHY S A. The nature relatedness scale: linking individuals' connection with nature to environmental concern and behavior[J]. Environment and Behavior, 2009, 41(5): 715-740. doi: 10.1177/0013916508318748 [32] MILFONT T L, SIBLEY C G. The big five personality traits and environmental engagement: associations at the individual and societal level[J]. Journal of Environmental Psychology, 2012, 32(2): 187-195. doi: 10.1016/j.jenvp.2011.12.006 [33] COSTA JR P T, MCCRAE R R, DYE D A. Facet scales for agreeableness and conscientiousness: a revision of the NEO personality inventory[J]. Personality and individual Differences, 1991, 12(9): 887-898. doi: 10.1016/0191-8869(91)90177-D [34] HIRSH J B, DOLDERMAN D. Personality predictors of consumerism and environmentalism: a preliminary study[J]. Personality and Individual Differences, 2007, 43(6): 1583-1593. doi: 10.1016/j.paid.2007.04.015 [35] WALUMBWA F O, SCHAUBROECK J. Leader personality traits and employee voice behavior: mediating roles of ethical leadership and work group psychological safety[J]. Journal of Applied Psychology, 2009, 94(5): 1275. doi: 10.1037/a0015848 [36] ADAMS R B, LICHT A N, SAGIV L. Shareholders and stakeholders: how do directors decide?[J]. Strategic Management Journal, 2011, 32(12): 1331-1355. doi: 10.1002/smj.940 [37] JAIN T, ZAMAN R. When boards matter: the case of corporate social irresponsibility[J]. British Journal of Management, 2020, 31(2): 365-386. doi: 10.1111/1467-8551.12376 [38] NADEEM M, BAHADAR S, GULL A A, et al. Are women eco-friendly? board gender diversity and environmental innovation[J]. Business Strategy and the Environment, 2020, 29(8): 3146-3161. doi: 10.1002/bse.2563 [39] COMPTON Y L, KANG S H, ZHU Z. Gender stereotyping by location, female director appointments and financial performance[J]. Journal of Business Ethics, 2019, 160(2): 445-462. doi: 10.1007/s10551-018-3942-y [40] MILLER T, DEL CARMEN TRIANA M. Demographic diversity in the boardroom: mediators of the board diversity-firm performance relationship[J]. Journal of Management Studies, 2009, 46(5): 755-786. doi: 10.1111/j.1467-6486.2009.00839.x [41] HIRTH S, VISWANATHA M. Financing constraints, cash-flow risk, and corporate investment[J]. Journal of Corporate Finance, 2011, 17(5): 1496-1509. doi: 10.1016/j.jcorpfin.2011.09.002 [42] 鞠晓生, 卢荻, 虞义华. 融资约束、营运资本管理与企业创新可持续性[J]. 经济研究, 2013(1): 4-16. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ201301003.htm [43] VOEGTLIN C, SCHERER A G. Responsible innovation and the innovation of responsibility: governing sustainable development in a globalized world[J]. Journal of Business Ethics, 2017, 143(2): 227-243. doi: 10.1007/s10551-015-2769-z [44] PETERS R H, TAYLOR L A. Intangible capital and the investment-q relation[J]. Journal of Financial Economics, 2017, 123(2): 251-272. doi: 10.1016/j.jfineco.2016.03.011 [45] BRYANT P T. Imprinting by design: the microfoundations of entrepreneurial adaptation[J]. Entrepreneurship Theory and Practice, 2014, 38(5): 1081-1102. doi: 10.1111/j.1540-6520.2012.00529.x [46] 王旭, 王非. 无米下锅抑或激励不足? 政府补贴, 企业绿色创新与高管激励策略选择[J]. 科研管理, 2019(7): 131-139. https://www.cnki.com.cn/Article/CJFDTOTAL-KYGL201907013.htm [47] 许年行, 李哲. 高管贫困经历与企业慈善捐赠[J]. 经济研究, 2016(12): 133-146. doi: 10.3969/j.issn.1673-291X.2016.12.063 [48] EWERT A, PLACE G, SIBTHORP J. Early-life outdoor experiences and an individual's environmental attitudes[J]. Leisure Sciences, 2005, 27(3): 225-239. doi: 10.1080/01490400590930853 [49] 和欣, 曾春影, 陈传明, 等. CEO早期居住地环境污染与企业战略差异——基于情绪特质的实证研究[J]. 经济管理, 2021(1): 89-105. https://www.cnki.com.cn/Article/CJFDTOTAL-JJGU202101007.htm [50] 齐绍洲, 林屾, 崔静波. 环境权益交易市场能否诱发绿色创新?——基于我国上市公司绿色专利数据的证据[J]. 经济研究, 2018(12): 129-143. https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ201812010.htm -

下载:

下载: